CHALLENGES FOR LNG AS MARINE FUEL

CHALLENGES FOR LNG AS MARINE FUEL

International Marine Organization (IMO) has introduced restrictions on emissions that will come into force in 2015 in the Emission Control Areas and 2020 for the rest of the world. In order to be compliant with these restrictions, business as usual is no longer an option for the ship-owners. Several solutions are being evaluated, however, LNG has the possibility of remaining the leading candidate in order to retain a substantial share of the world bunker market: proven technology (around 40 ships running on LNG), more than meeting the new emissions requirements and less CO2 emissions. In addition, economics are in many cases in favor of LNG. However, several uncertainties need to be further evaluated and solutions found in order to have LNG become the preferred choice also in this segment. Investments have to be committed all along the value chain and the market faces the classical chicken-and-egg dilemma: Longer term volume commitment from both suppliers and ship-owners that can justify the investments required. The solution will probably be a longer term ramp-up of supply and demand in line with progressive infrastructure investments. Development of regulations, codes and standards has to be made to balance carefully the excellent safety records of the LNG industry without too constraining barriers for the development of new LNG infrastructure required to supply the marine fleet. The world's potential bunker market is equal to the world's LNG production. Consequently, the questions of LNG availability and value/pricing have to be further evaluated. Bunker LNG has a realistic potential to represent around 45 Mtpa by 2030, which is equal to LNG classic trains dedicated. In the future, with an expected even tighter energy market, LNG for bunker will naturally be in competition with other LNG markets.

From a pure economic point of view, new investments have to be made all along the value chain and the market faces a classical “chicken-and-egg” situation. This can only be overcome with long term commitments , aggregated volumes and long term vision from stakeholders. A progressive and risk limited ramp up of the market is required in order to meet long term objectives and requirements.

Regulation, codes and standards have to be developed in a manner whereby safety track record as regards the LNG industry is maintained, without introducing unnecessary too high barriers for the required infrastructure’s development.

Since the world’s bunker market has potentially the same demand as the world’s LNG production today, the question of LNG availability has also to be further studied. Bunker LNG could realistically represent around 35 Mtpa by 2030 which equals 7 LNG trains dedicated to this market only In the future with tighter energy markets, bunker LNG would compete with other requirements/need for LNG.

For decades, transport fuel was almost exclusively oil-products for the simple reason that oil was abundant, practical and cheap. Natural gas in general and LNG in particular were recognized as having attractive advantages over oil in terms of energy content (energy per mass unit) and environmental footprint. However, since it was less readily available and more expensive, LNG has continued on the whole to be limited in application to research and very small niche market. In recent years, however, several key trends have converged to radically alter the landscape and the situation is now on the brink of a material change.

A growing portion of oil production is now operated by national companies, making oil a core geopolitical focus. This also restricts the availability of resources from certain countries, aggravating the imbalance between supply and demand.

In the mid-2010s, the US shale gas revolution brought considerable gas reserves to the market, and the surplus supply sparked a price drop in the USA. Spot gas prices became more competitive and started to decorrelate from oil prices. The North American reserves/production ratio is expected to climb from 12 years to as much as 250 years.

The same period saw quantities of LNG produced from new sources, with new producers Egypt, Equatorial Guinea, Norway, Peru and Yemen all eager to join the “club” of exporters, while the traditional producers, Qatar in the lead, upped their output.

Climate change and reduction of air emission became key issues, and not only for mature markets. This brought changes in the regulatory framework, reducing the thresholds of both GHG and local pollutants (particle matter, NOx, sulfur…). On this score, natural gas’ cleanliness and single carbon molecule enable it to meet the lower emission levels more easily than any other fuel of hydrocarbon origin. Electricity, on the other hand, eliminates local emissions but increases GHG effects depending on the fuel used in power plants, and is still limited by storage capacity.

The technological progress achieved in liquefaction, storage, handling and combustion of natural gas and LNG also contributed to the boom in interest for LNG.

All in all LNG has become a credible challenger to oil products for marine and heavy-duty transportation. However, the lack of infrastructure for LNG retailing and the limited number of LNG-fueled vehicles creates a challenge. Therefore, the emergence of an LNG market for marine and heavy-duty transport depends on powerful drivers being in place to break the stalemate. At least two of them are already identified.

LNG COMPETITIVENESS VERSUS OTHER SOLUTIONS

Ship-owners have only three realistic alternatives to achieve compliance with theSOx regulations: use MDO (marine diesel oil), install scrubbers on board the ships, or convert ships to run on LNG. The others (DME, nuclear, etc.) are considered having insufficient potential to represent significant volumes.

To meet the NOx regulations, only an LNG solution will in theory comply with Tier III. Ships will need to install systems to reduce NOx (like SCR systems) if running on MDO or HFO in any case.

Qualitative aspects - MDO Solution

Economic issues aside, MDO appears to be the easiest solution for ship-owners. Only new-build ships after 2016 will need to have an SCR installed on board, and its technology and feasibility are not seen as any major hurdle in either ship design or operability terms.

Most ship-owners are familiar with and use MDO, Besides, its market mechanisms and variations are very similar to HFO. MDO has the added advantage of necessitating no changes in commercial relations or general contract terms with bunker suppliers. The structure will continue to be based, as it is today, on product specifications clauses, incoterms, indexation and so on.

Usually, MDO is already available in ports and there are no problems regarding regulations, logistics or operations. Nevertheless, if the quantities of MDO delivered in ports rose significantly, the capacities of the current infrastructure and logistics means would need to increase to accommodate them. The logistics of oil products is well known and widely available, but capacities will need to be converted and/or further developed in most of the ports. Naturally, the level of investment needed is much lower than for LNG and the feasibility therefore higher.

Another probable challenge of significant additional demand is the impact on the refining balance of each region, which in turn might affect prices, especially in Europe, which already imports around 20 Mt of distillates each year. The impact on refining and on the price of distillates is outside the scope of this paper, as the subject is complex and would require considerable development.

Use of Scrubbers

The use of exhaust-gas scrubbers appears a very promising solution for many ship-owners. The technology is not, for the time being, fully proven for ships but the stakes are high enough to serve as incentive to resolving the obstacles.

Scrubbers offer many advantages over other solutions, the most important being the ability for the shipowners to maintain their current practices in terms of supply. Although the technology is not fully proven, it seems that retrofitting would be feasible for many of today’s ships. In any case, ship-owners can include in the design of the ship the possibility of installing a scrubber at a later date, which would make retrofitting possible.

This being said, scrubbers may cause problems of stability for some ships, since the exhaust gas treatment has to be installed on top of the exhaust stack. Ferries for example appear to be poor candidates for scrubbers. In addition, water treatment products and sludge management require additional logistics and operations for ships. Another drawback of scrubbers is that, in economic terms, fuel consumption will increase by between 1 and 3% and maintenance costs and OPEX are also higher.

LNG

There are around 35 ships in the world today running on LNG, not counting LNG carriers and as many more are already on order or under construction. LNG technology is known and well proven and many players are dedicated to improve current products to optimize both costs and engine efficiency. LNG combustion emits zero SOx and engine manufacturers often claim that LNG engines will meet Tier III requirements, but this has yet to be proven for several engines.

Choosing LNG has a number of advantages compared to traditional fuels. In addition to complying with regulations concerning SOx and NOx, natural gas combustion emits around 20% less CO2 on a tank-towheels basis, although some studies deem reduction rather at around 10% on a well-to-wheels basis. Furthermore, a major advantage of LNG is that engines need much less maintenance as gas combustion is significantly cleaner than its HFO or MDO counterparts.

However, some drawbacks to the adoption of LNG as ship fuel certainly exist. While its density is much lower than that of traditional fuels, the space occupied by the tanks is higher. In addition, type C tanks are usually cylindrical which is not positive for optimizing space on board and, for safety reasons, more space is needed to isolate the gas system. The overall volume occupied for all LNG facilities on board is between 3 and 4 times higher than for conventional fuels, which represents a significant loss of cargo space for most types of ships. A membrane solution, currently under development, would definitely minimize this problem. In addition, retrofitting is very unlikely for most ships if their design has made no possibility for this option. Sometimes, however, it would be possible for tankers to install type C reservoirs on the deck.

The main disadvantage of LNG as a marine fuel is its availability. Not only does the supply chain yet have to be developed, but the challenge concerning availability makes LNG unsuitable for ships that require flexibility in their routes, like VLCCs or bulk carriers. Further limitations include safety requirements concerning LNG bunkering, maintenance and commercial operations, which adds complexity and the need for skilled and trained crews, and hence the types of ship suitable for running on LNG.

Market potential for LNG

There will obviously not be only one solution chosen for ship-owners to comply with the new regulations. Many factors have to be considered to determine the best solution: the type and age of the ship, its route, its secondary market, the owner’s financial strength, competition among ship-owners, qualification of crew, value of the cargo (and hence of the potential loss of cargo space), experience of the owners regarding LNG, global, regional and local availability of the products etc. The world bunker market will certainly be split between the different solutions.

LNG appears to be a suitable solution in many cases. Certainly, the economics are not always in favor of LNG (depending on forecasted prices) but all aspects have to be addressed. The development of LNG as bunker fuel will necessarily be progressive and slow.

In a first phase of development, short sea ships in ECA with fixed routes will develop a high proportion of new-build ferries and RO-ROs and a small share of new-build or existing product tankers. The ships will be impacted by the regulations in 2015 and competition between ship-owners is strong. Because of design and stability issues, many of these ships will not be able to install scrubbers. Many inland ships will run on LNG as well, which should increase the LNG quantities available in port in order to reach a certain scale.

In a second phase, some deep sea liners will run on LNG. These will be mostly new-builds since retrofitting appears very challenging to perform. Major container-ship operators will first test this solution by ordering a few ships to run on LNG, but in view of the consumption, this would add up to significant volumes. If the tests prove positive on operational and economic aspects, container-ship owners will most likely decide to diversify their fuel and technological risks by switching part of their fleet to LNG.

A third phase of development will start around 2025, once LNG is available in several ports in North America, Europe and Asia. Short sea ships without fixed routes but sailing in regions where LNG is available may then convert. Some deep sea VLCCs or Bulk carriers could run on LNG as well, but the need for flexibility in the routes could reduce this possibility. It is naturally difficult to predict the volumes at stake that might switch to LNG in this phase but it is unlikely that LNG will be a common fuel for these ships. A conservative estimation would be around 5-10 Mtpa by 2030.

SUPPLY CHAIN

The requirement to initiate and construct the complete supply chain is seen as a majorhurdle for the development of bunker LNG. Effectively, there are very few supply points for bunker LNG, even though LNG is already available in many places. The further logistics are required to transport it to the port, store and bunker the ship.

The starting point of this supply chain depends on the region and thereby its availability of LNG or pipe gas, importing or exporting region, extension of the region and port density and so on. Every case has to be considered separately, taking these characteristics into account.

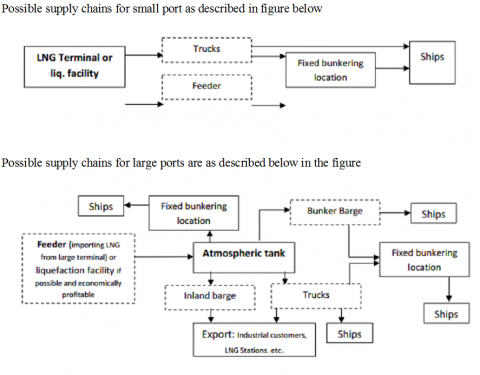

Possible supply chains for small port as described in figure above

Possible supply chains for large ports are as described above in the figure